Imagine being a fly on the wall during the lawsuit between Sarah Baker and Blue Cross, where Baker, after suffering a stroke, was denied her long-term disability benefits.

In a surprising turn of events, Blue Cross was ordered to pay a hefty $1.5 million in punitive damages. This verdict, like a ripple in a pond, has created waves that could potentially reach all corners of the insurance industry.

But how does this affect you as a policyholder? Let’s dissect the potential implications this case could have on your future interactions with insurance companies.

Key Takeaways

- Blue Cross was ordered to pay $1.5M in punitive damages for mishandling disability claims.

- The court emphasized the importance of significant punishment for deterrence in the insurance industry.

- Insurers demonstrating bad faith or denial strategies could face similar hefty penalties.

- The ruling reinforces the need for insurance companies to act in good faith towards policyholders.

Case Overview: Baker v Blue Cross

Diving into the Baker v Blue Cross case, you’ll find that it centers around Sarah Baker, a plaintiff who courageously sued the Blue Cross Life Insurance Company of Canada after her long-term disability benefits were unjustly denied. Suffering a stroke at 38, she was initially denied long-term ‘own occupation’ benefits. Upon taking her case to court, she was awarded retroactive benefits, mental distress damages, and a stunning $1.5 million in punitive damages.

The court declared Baker totally disabled, making a clear statement about her entitlement to long-term disability benefits. Blue Cross’s high-handed conduct was also exposed: they’d stopped benefit payments on three occasions, relied on incorrect medical opinions, distorted assessment reports, and ignored conflicting medical evidence. The court’s decision highlighted the importance of proper assessment in insurance coverage, a consideration vital for both insurance companies and plaintiffs.

The Ontario Court of Appeal upheld the trial court’s decision, dismissing Blue Cross’s appeal. This landmark case underscores the implications of mishandling disability claims for insurance companies. It’s a case that sets a significant precedent and sends a clear message about the rights of policyholders.

Understanding Punitive Damages

To truly grasp the implications of the Baker v Blue Cross case, it’s crucial to understand the concept of punitive damages and their role in legal disputes. Unlike other types of damages, punitive damages aren’t meant to compensate the plaintiff for losses. Instead, they’re designed to punish the defendant for particularly egregious behaviour and deter them—and others—from engaging in similar conduct in the future.

In the context of insurance disputes, punitive damages can be awarded when an insurer’s behaviour is found to be especially egregious or conducted in bad faith. For instance, if the insurer:

- Denies a claim without a reasonable basis,

- Deliberately misrepresents policy terms,

- Fails to conduct a proper investigation,

These actions could lead to a punitive damages award. Again, the aim isn’t to compensate the insured for a loss but to send a clear message to insurance companies about the consequences of unfair practices.

In the Baker v. Blue Cross case, the $1.5 million in punitive damages reflects the court’s judgment that Blue Cross’s actions weren’t just mistaken but recklessly indifferent or intentionally harmful. This ruling has significant implications for both insurance companies and policyholders.

Determining Punitive Damages Amount

In light of the $1.5 million punitive damages awarded in the Baker v Blue Cross case, it’s crucial to understand how courts determine the amount of these damages. The process isn’t arbitrary; it’s driven by a set of defining factors.

The primary purpose of punitive damages is to punish the defendant for egregious behaviour and deter similar conduct in the future. The degree of reprehensibility of the defendant’s conduct plays a significant role. In this case, the court considered Blue Cross’s reckless indifference and deliberate denial of benefits as high-handed conduct that warranted a severe penalty.

The court also considers the defendant’s financial status. The aim is to ensure that the punishment stings, thereby deterring future misconduct. Hence, the court deemed $1.5 million—a substantial sum for most—a proportionate punishment for a large corporation like Blue Cross.

The Controversial Costs Decision

Just as intriguing as the punitive damages in the Baker v Blue Cross case is the controversial decision on costs, which has sparked considerable debate in legal circles.

Here’s why this decision is significant:

- Unprecedented Full Indemnity Costs: The court awarded Baker full indemnity costs, a rare move that’s been hotly debated. This award means that Blue Cross has to cover all of Baker’s legal fees, protecting her disability benefits from being eroded by legal costs.

- Impact on Insurance Companies: This decision sends a strong message to insurance companies. They must ensure fair treatment of policyholders or risk facing hefty costs. It increases their accountability and deters any attempt to deny claims without substantial evidence.

- Influence on Future Litigations: The ruling sets a precedent that could influence future litigations. It gives hope to policyholders that they can take on large insurance companies and win, without the fear of incurring massive legal fees.

In a nutshell, this controversial cost decision is a game-changer. It’s not just about punishing Blue Cross; it’s about making the insurance industry more accountable and fair to policyholders.

Implications for Insurance Policyholders

While the Baker v Blue Cross case’s controversial costs decision shakes up the insurance industry, it’s equally important to consider what this means for you as a policyholder. This landmark ruling sends a clear message to insurers, reinforcing their duty to act in good faith. If they fail to respect this obligation, they may face significant punitive damages, as Blue Cross did.

This decision strengthens your position as a policyholder. If you’re unjustly denied benefits, you now have a precedent indicating that courts won’t tolerate such behaviour from insurers. It also encourages insurers to be more thorough in their assessments and fair in their judgments.

The ruling also suggests that suing your insurer for bad faith is a viable option, even if it seems daunting. Courts have shown they’re willing to award substantial damages and cover legal costs in such cases. However, consulting with a legal expert before proceeding is crucial, as each case is unique.

Moreover, this case may prompt changes in the insurance industry. Companies could start implementing stricter protocols to avoid such costly mistakes. While this could lead to a more meticulous claim review process, it also means a fairer treatment for policyholders like you.

Frequently Asked Questions

What Legal Options Does a Policyholder Have if an Insurer Like Blue Cross denies Their Disability Claim?

If your disability claim is denied by an insurer like Blue Cross, you’ve got legal options. You can appeal the decision within the company.

If that doesn’t work, you can file a lawsuit. If the denial is unfounded, you can claim retroactive benefits and even punitive damages in court.

How Does the Court Determine the Amount for Punitive Damages in Cases Like Baker v Blue Cross?

The court examines the insurer’s conduct in determining punitive damages, like in the Baker v Blue Cross case. If they’ve acted in bad faith or shown reckless disregard for their duties, this can justify punitive damages.

The amount aims to punish and deter future misconduct. The size of the insurer matters too, as larger organizations may require a heftier sum to feel the sting. It’s about making sure they don’t repeat their wrongful actions.

How Often Are Full Indemnity Costs Awarded to Plaintiffs in Disability Insurance Cases?

Total indemnity costs aren’t often awarded in disability insurance cases. They’re typically seen in instances of bad faith or misconduct by the insurer.

In the Baker v Blue Cross case, such costs were justified due to the insurer’s conduct. Remember, every case is unique so that outcomes can differ.

It’s crucial to consult with a legal professional to understand the potential costs in your specific situation.

What Does This Case Mean for Future Conduct and Policies of Insurance Companies Like Blue Cross?

This case sets a precedent, reminding insurance companies like Blue Cross to act in good faith. It’s a clear warning that unfair claim denial can lead to substantial punitive damages.

For you, it’s reassurance that you have legal recourse if you’re unfairly denied benefits. It’s also a call for insurance companies to review and improve their claim-handling processes to avoid similar consequences.

How Can This Case Impact the Approach of Insurance Companies Towards Claims Assessment and Decision-Making?

This case could significantly impact insurance companies’ claims assessment and decision-making approach.

It’s a reminder to treat your claims fairly and in good faith.

If you’re in a similar situation, the court’s decision suggests that insurance companies who act in bad faith could face substantial punitive damages.

This might prompt insurers to reevaluate their policies and practices to avoid such costly penalties.

Conclusion

This landmark ruling against Blue Cross underscores your rights as a policyholder. It sends a clear message to insurance companies: wrongful denial of claims won’t go unpunished.

The substantial punitive damages awarded set a precedent, potentially reshaping how disability claims are handled. This case reminds insurance companies to maintain good faith with you, their policyholder, or face severe financial consequences.

Ultimately, it’s a win for policyholder rights and fairness.

References

Baker v Blue Cross, 2023 ONSC 1891

https://www.canlii.org/en/on/onsc/doc/2023/2023onsc1891/2023onsc1891.html

Baker v Blue Cross Life Insurance Company of Canada, 2023 ONCA 842

https://www.canlii.org/en/on/onca/doc/2023/2023onca842/2023onca842.html

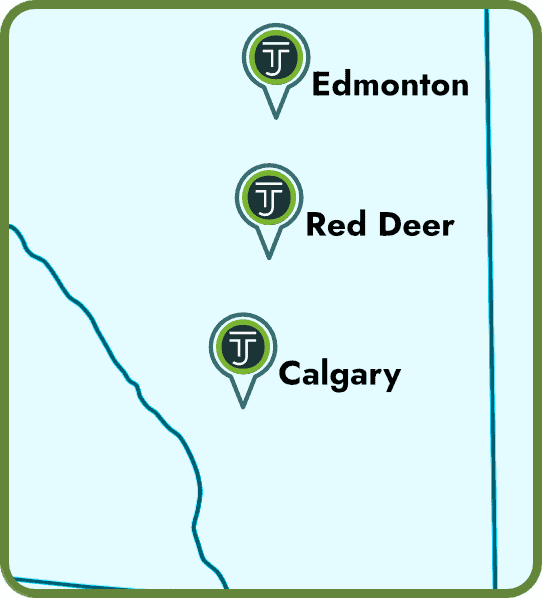

We currently have three offices across Alberta — Edmonton, Calgary, and Red Deer. We serve the entire province of Alberta (and BC). We also have the infrastructure to work with any of our clients virtually — even the furthest regions of Alberta.

Call 1 (844) 224-0222 (toll free) to get routed to the best office for you or contact us online for general inquiries.

We also have a dedicated intake form to help you get the ball rolling. Our intake team will review your specific case and advise you on the next steps to take as well as what to expect moving forward.

Our offices are generally open 8:30 a.m.—5:00 p.m., Mon—Fri.

Colin Flynn

WORKPLACE LAWYER

Colin is an experienced lawyer practicing in the areas of Labour & Employment, Civil Litigation, Estate Litigation, Corporate & Commercial Litigation, and Personal Injury. He places high emphasis on developing trusted relationships with his clients, ensuring they feel comfortable and at ease sharing the subtleties of their circumstances.

PRIVACY NOTICE: Any information you provide to our office — whether your personal information or employment/employer details — will be treated as strictly confidential and will not be disclosed to your employer or to any other third party. So, please be reassured that you can talk openly to our capable Intake Paralegals worry free. Fill out an Online Inquiry or call us now, your information will be in safe and helping hands.

The Legal Review Process by Taylor Janis Workplace Law

- Taylor Janis strives for high-quality, legally verified content.

- Content is meticulously researched and reviewed by our legal writers/proofers.

- Details are sourced from trusted legal sources like the Employment Standards Code.

- Each article is edited for accuracy, clarity, and relevance.

- If you find any incorrect information or discrepancies in legal facts, we kindly ask that you contact us with a correction to ensure accuracy.